Why buy now?

It’s unlikely that the prices will go much lower than current levels. Why?

– There was an oversubscribed PIPE at $14 (PIPE=Private Investment in Public Equity – institutional investors that wanted in on the deal), so investors are viewing it as a good buy.

– Other hedge funds and institutional investors are buying in, according to whale wisdom.- The low volume means that people are buying and holding the shares. If the share price falls on a particular day and the volume was only 5000 but there are 23,000,000 shares outstanding, did it really fall by all that much?

– The stock recently did well on the good news that Steffen Pietszke was made CFO. Any news that shows the stock will convert will cause share prices to rise.

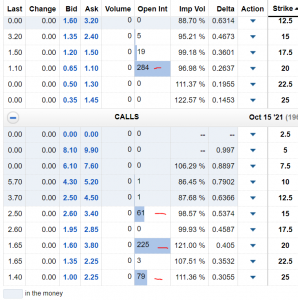

– The SPAK ETF (the etf which tracks spac stocks) has reached an all time low. Buy low, sell high, right?- Take a look at the option chain. Looks like something might happen in July or October? (Note: These option calls do not include any of my positions shown above):

I understand 400 contracts isn’t a lot of money in the grand scheme of things, for a low volume stock, it actually means a lot.

Anyway, that last part was more speculation than anything, but still – stock is low right now. Now is the time to buy in!

Weekend reading material? You got it.Check out this page which covers Enovix’s strategy, if you’re not up to date with it already. It goes over many of the reasons behind why they’re focusing on mobile batteries before moving to EVs and where they want to position themselves in a few years.

Anyway, that’s it for this week. There’s not too much else to report. Might be taking a few weeks off here.