There was a major news dump yesterday with an SEC filing (S-4) available on their website: tm217682-1_s4 – none – 43.6878596s (rodgerscap.com). I’d imagine you’ll be getting this in the mail soon enough.

This document covers the business combination action, how the new shares are distributed pre and post merger, how warrants are exercised, shares converted, who owns majority stakes where. In short, the document asks shareholders for a vote on the combination and shares a ton of information about that combination. Seriously, there’s a ton of information here. But hey, I’ve already read through most of the document (not line-by-line of course), so I can share some of the juicier details.

Full disclosure:I currently own 24000 shares of RSVAU. It comprises a substantial part of my investment portfolio. These newsletters contain my market moves and interests. I am not anyone’s financial advisor. You make all of your own choices regarding your portfolio. My actions may be wrong and, if taken, may subject you to financial loss. Proceed at your own risk.

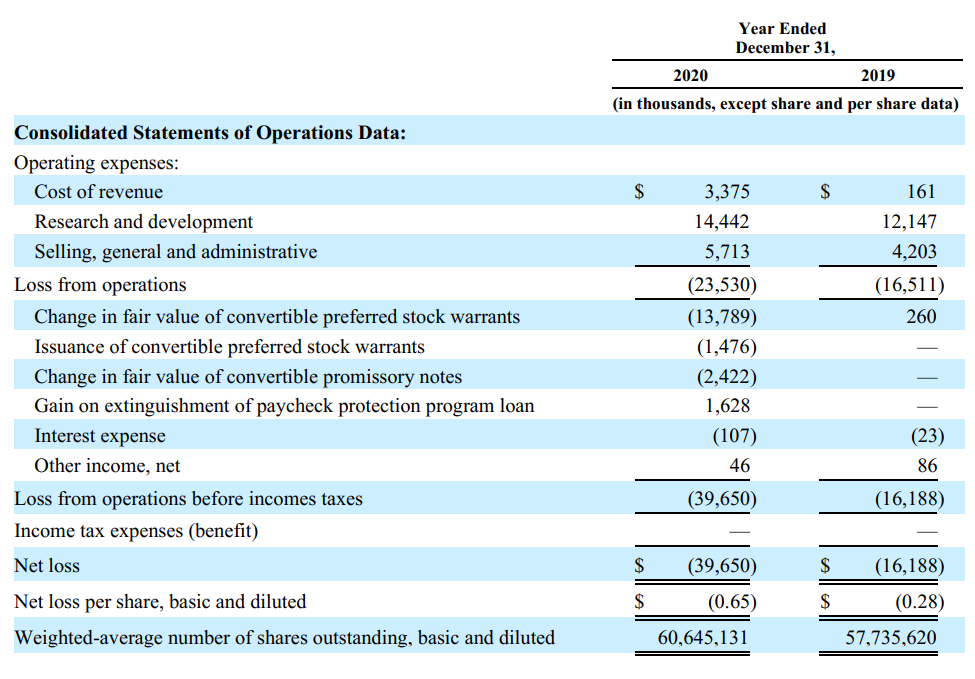

Statements of data:

(Page F-23)

Please note that the auditors found irregularities with the data that had to be reported in the document. This is mainly because the company lacks CFO leadership and this was one of the requirements, as stated by TJ Rodgers and all of the RSVA team, that would be required of Enovix going forward. That aside, these numbers should be verified as true.

I’m frankly surprised that the financial statement isn’t worse, given that they need to spend a considerable amount of money getting Fab-1 up and running and expansion. But let’s look at this a little deeper. From the SPAC IPO and the PIPE (public investment in private equity – basically institutional investors that were able to pump more money to juice the IPO and give Enovix more money), Enovix should have about $375M (after paying for IPO costs including legal and transactional fees) to play with. This has to be enough money for them to do the following:

– Achieve profitability within the next 2 years

– Buy and acquire a new Li-ion battery plant and convert it with Enovix technology (possible plants they want to buy is included in the investor presentation found at Enovix’s website)

– Begin developing EV batteries and joint ventures

If they’re unable to do it with this amount of money, they may need to issue more shares to get where they need to be. Will they be able to do it? As a completely armchair observer, I think that should be enough money provided that Fab2 is domestic. If they buy a foreign Fab2 (as shown in the investor presentation), they will need to have an entirely new local management team, cultural differences, new supply lines, and trying to outcompete local competition from abroad when Enovix would be a new contender. I’d place a foreign Fab2 as high risk and domestic Fab2 as considerably lower risk. In the presentation, I saw some fabrication plants located in the midwest. Considering the cheaper price of real estate and prime location to the car industry in the Rust Belt, think that might be the way to go. But again, I’m just an armchair observer.

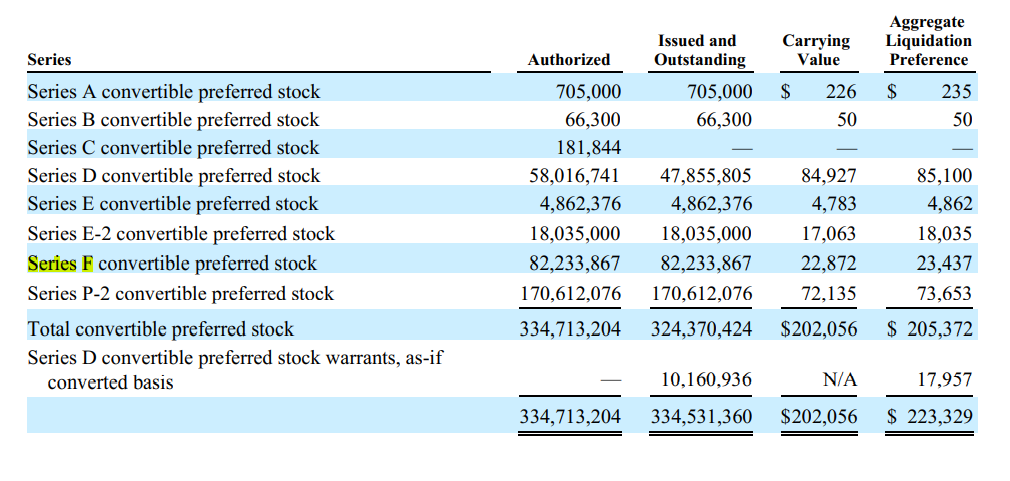

Share dilution:

Whenever a company seeks new investors, usually they seek money for the next two years. An IPO is no different. Investors don’t want to buy into a company that’s more than 2 years out from being profitable as that’s too risky and it may fail.

Given that this company has been around since 2006 and has been burning money ever since, I’d expect to see many rounds of funding and lots of share dilution. The financials don’t surprise me

(page F-38)

No surprises here. There are 8 rounds of funding since 2006. That’s one round every 22.5 months. As expected.

Background of the business combination:

(Page 73)

If you look at this area, it creates a timeline of how Enovix was chosen from December through February. It makes several references to companies that they were looking to acquire that are pretty easy to figure out (some harder than others, I wasn’t able to do so). Pretty interesting to find out who RSVA could have been!

– “Mr. Gomo, … a director of a solar company, met with the CEO of that solar company” –> Pretty easy to figure out. Solaria High Power Solar Panels | All-Black Solar Panels | Solar Panels | Solar Systems for Homes

– “Mr. Malchow having professional affiliation with the founder of an artificial intelligence and logistics enterprise software company” –> Wasn’t able to figure out who this is.

– “Mr. Hernandez held a call with the CEO of an Australian artificial intelligence company” –> Bluechip Infotech – Helping Your Business Grow (bluechipit.com.au)

– “Mr. Malchow conducted an analysis of a specialty industrial chemical manufacturing company” –> Malchow runs his own fund HNVR, but I was not able to find the companies he’s invested in.

– “Mr Reichow held discussions with the CEO of an artificial intelligence processor company” Fulfillment Solutions & Warehouse Automation | 6 River Systems (??? not sure)

– “Mr. Reichow held sessions with an industrial manufacturing solutions company” –> VulcanForms – Highest Productivity Industrial Metal Additive Manufacturing

Anyway, interesting to see the companies they could have purchased.

In choosing Enovix, TJ Rodgers was not a part of those discussions. He excused himself from all conversations.

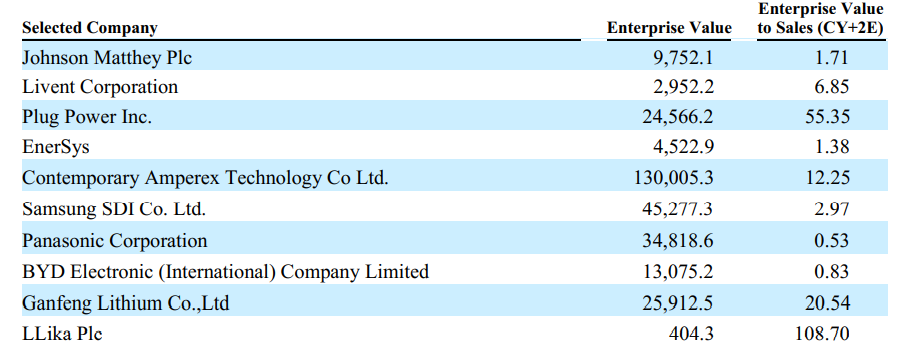

Competitors:

(Page 87)

In my last newsletter, I looked for competitors, specifically ones that have created a silicon anode. I wasn’t able to find one suitable to compete directly with Enovix. But that’s not to say Enovix doesn’t have competitors. They will be competing against many mainstay competitors that produce regular Li-ion batteries. In determining the market valuation of Enovix, the company hired ThinkEquity to perform a market analysis to provide a fair evaluation of the company. Here were the competitors that ThinkEquity provided on the terms of “being in the clean energy market”.

Some of these companies are obvious competitors (Samsung, Panasonic, Plug power). The others I haven’t heard of or might be international companies. I’m not sure.

Then ThinkEquity looked at the valuation of “next generation battery companies” and listed these potential companies to determine valuation. Some of these I mentioned in my first and second newsletters!

Notice how Plug Power has been listed twice? Definitely a company to watch.

Ending:

Anyway, just wanted to go over some of the juicier details. If you’d like to read the whole document, definitely give it a read. A lot of it is boring drivel, as expected, but there are details that you might find interesting.