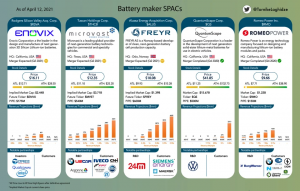

Battery Maker SPAC markets:

Let’s have a look at the competition within battery maker spacs. We’ll revisit Enovix later.

Microvast:

Since I’m not bullish on this stock, I’ll let /u/MVST_100_OR_BUST explain his position here. In short, THCB (MVST) looks to have huge amounts of revenues and partners from Ford, Oshkosh Truck… well, I’ll let the graphic above speak for themselves.

But…. the company is based in China with a remote HQ located in Texas. The graphic is a bit misleading. You can see their actual website here: 微宏 | 微宏动力系统|快速充电|电动车 | 纯电动公交 | 插电式混合动力|电网储能 (microvast.com.cn) (and they do have an English version available)

Furthermore, the deal has been mired with extensions to the SPAC. The SPAC was created in March, 2019, and they only found a company to merge with in December 2020. Since they need more time, they brought a shareholder vote to extend the SPAC to April 30. Since the sponsors and backers only have 50% of the SPAC, they depend on retail investors to hit the 65% vote required for the extension. After Microvast missed a filing deadline, THCB has to bring another shareholder vote to extend the combination from April through July. THCB sponsors and PIPE backers are asking all shareholders to vote for the approval and investor confidence is waning that they’ll be able to complete the combination. After all, look at the shareprice:

So yeah, due to mismanagement and not being able to find a merger until December – 3 months from having to file from the deadline, looks like the sponsors picked a good company but it’s mired in mismanagement.

Will it actually merge? Who knows, but they don’t have much time for more extensions. If shareholders vote not to extend, the business combination will be cancelled and moneys returned to shareholders.

Quantumscape:

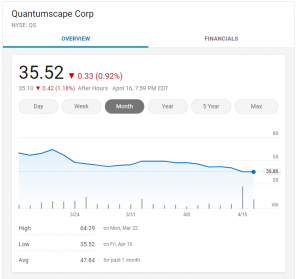

We’ll skip over Freyr for now to talk about QS which had a huge short seller, Scorpion Capital, release a 188 page damning report calling QS a completely fraudulent company with no product and a penchant for burning investor equity. Quantumscape, the Bill Gates-backed solid state battery company, is down 42% over this past month:

Romeo Power:

The stock tanked recently after Romeo, creator of a battery management system for commercial and government vehicles, severely downgraded its revenue forecasts from $140M to $40M. That’s a 70% drop. In the last month, share prices fell 40% from $13.50 to $8.

Freyr Battery:

So far, this company hasn’t been mired in short sellers, misaligned revenue expectations, or poor SPAC management, but who knows what the future will bring? This Li-ion battery maker out of Norway is currently trading at NAV ($10) and expects to complete their business combination with $ALUS sometime in the next month.

Enovix:

Perhaps the only bearish signal I see out of Enovix would be the constant lawsuits regarding the details behind the business combinations – that it was not a fair process and did not represent shareholder values. I think these lawsuits are without merit, and it doesn’t take much effort to look through the S-4 to determine that.

One more place to check out:

If you want to get a good idea of the current SPAC landscape, check out SPACHero. Pretty cool website!

Anyway, as I find more news, I’ll def share with you guys.