Recent RSVA performanceIt might be easy to look at RSVA performance recently and feel like this:

You could look at RSVA and think it’s getting hammered. Well, yes, it is, but let’s consider how it has performed relative to other SPACs. Here is a chart that was distributed on /r/spacs on reddit this past week (chart not made by me):

Well would you look at that… RSVA is near the top! It has performed well above almost all other SPACs.

How about customers?

In previous weeks, we looked at who the possible competitors for Enovix would be (in short: no direct competitors in silicon-anode technology, but there are indirect competitors from traditional li-ion battery manufacturers). So who exactly do we know they’re selling to?

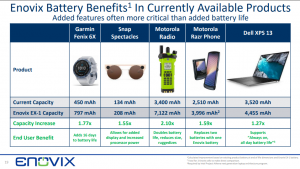

They gave examples of what Enovix’s batteries could do compared to the competition. I don’t think these guys are actual customers though.

In previous investor rounds, the top non-dilutive investors were:

– Qualcomm (mobile devices)- Intel (this one I’m not sure about – what would Intel sell that would need Enovix’s technology? I’m betting some sort of laptop, but Intel doesn’t make laptops directly)

– They’ve already hinted at a Motorola partnership with two potential products up there. Plus, one of the Directors, Jerald Hallmark | Enovix, worked at Motorola. There could be connections there.

But hey, while we’re just dreaming, why don’t we dream high?

– The obvious Tesla. If they could take Panasonic out of that partnership (A 32B market cap company!) that would be amazing. Even if Tesla said, “Yeah, we’re going to work with Enovix on getting their technology to work with our platform, supplanting the 4680 battery”, that would be grand!

– Apple, but I don’t think Enovix would have the capacity to produce enough batteries for the Apple ecosystem. They’d have to create a lot more partnerships before that would be possible.

– Realistically, maybe GoPro? Dell? HP?

Oh well, at this point we can only dream. The only sure thing that we have right now are some sort of mobile devices, and considering they were early investors before Fab-1 was even made, they’re going to get priority.

Studying RSVAU

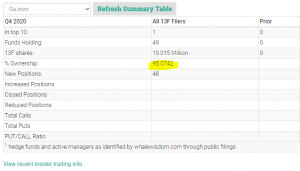

Have you ever wondered why there is very little volatility in RSVAU? I can tell you why. Check out a site called Whale Wisdom. Investment funds must submit form 13-F to the SEC which details their holdings. Whale Wisdom collects these filings and displays them for free on their website. So, take a look at RSVAU!

So, hedge funds own 19.015M shares, resulting in 95% ownership of the shares. You can scroll down and view the holdings of each of these large funds.

So, want to know why the volume is so low? Look up RSVA. It doesn’t even show on the site. Institutional investors aren’t buying or selling. Low volume indeed!

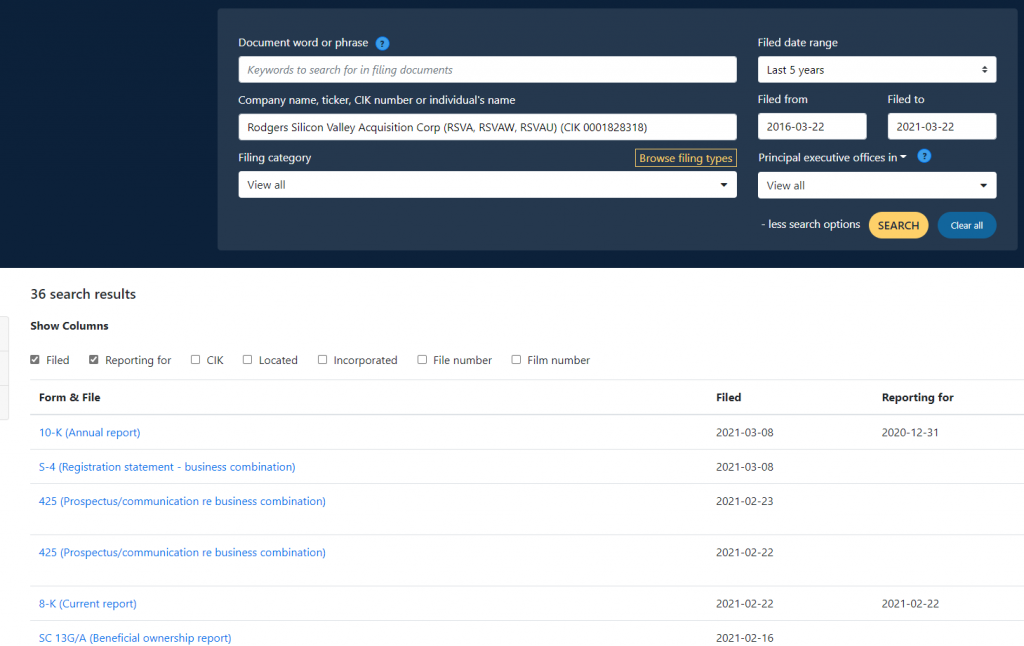

Get SEC filings immediately:Want to see when a company sends out an SEC filing? Want to do it for free? EDGAR is here to help!

SEC.gov | EDGAR Full Text Search

This is a free service provided by the SEC / US Government that allows you to search by ticker symbol. You can sign up for free email alerts and be notified whenever there’s a new filing. Go ahead, put in RSVA.

Here you can see all their most recent filings.

You can search for any publicly traded company and see all their filings, get free email alerts, and look back historically. Personally, I signed up for the email alerts. To be a proactive investor, I suggest you check it out too!

Interesting Tidbit:Did you know that Enovix used to be called MicroAzure? I suppose they changed their name once Microsoft released Azure, their cloud platform. Guess that was a wise move. I do wonder how they settled on the name Enovix, though.